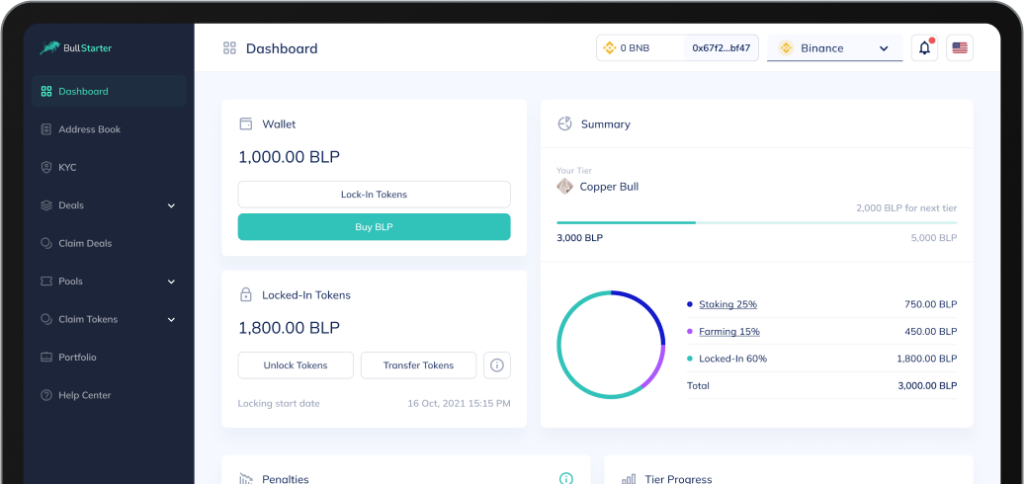

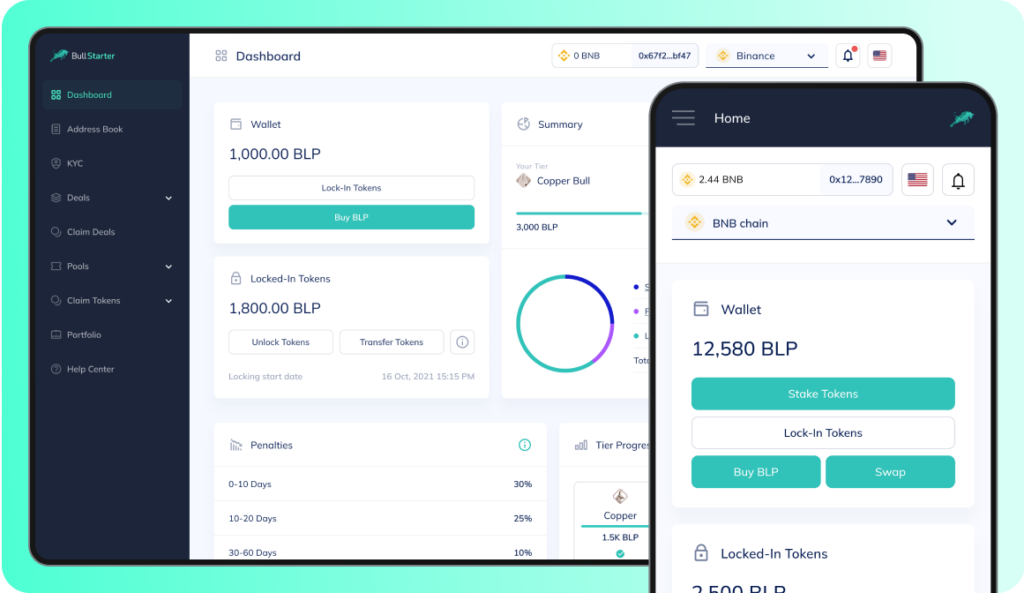

The centrepiece of the ecosystem, Bullstarter is our multi-chain IDO launchpad, enabling early-stage projects to raise funds from our vetted community of trusted supporters.

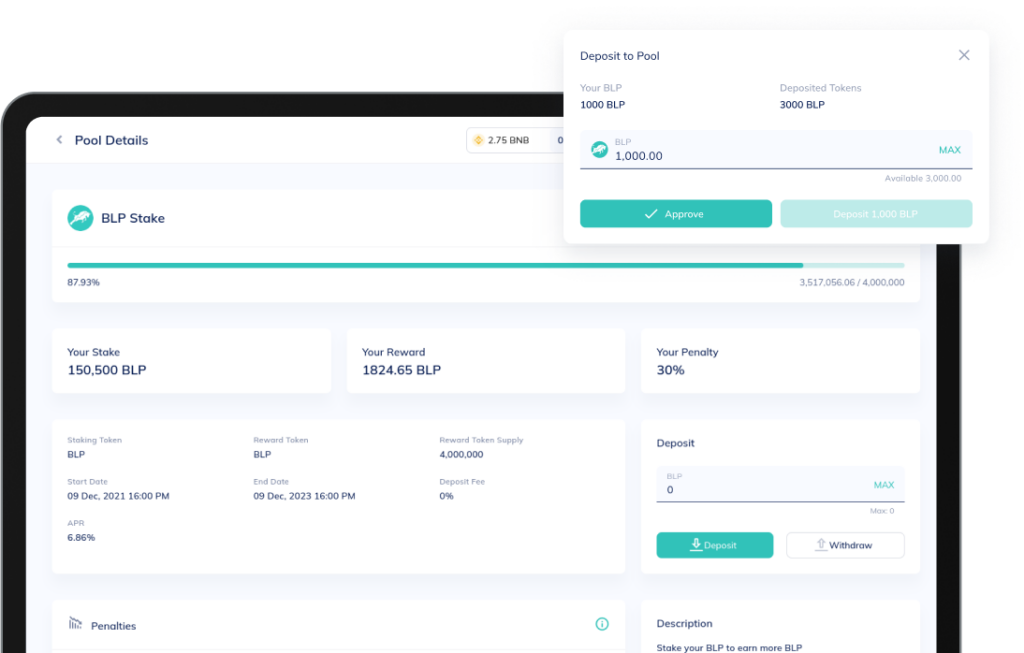

Lock up your tokens, help power our ecosystem and receive crypto rewards for your loyalty to our community and ecosystem!

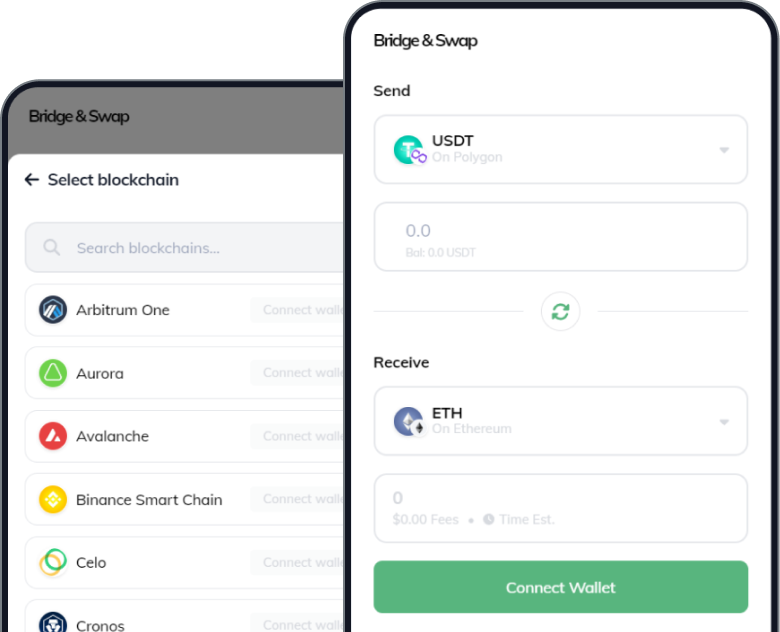

Simple, efficient and low-cost tool enabling both swapping between cryptocurrencies and bridging across blockchains

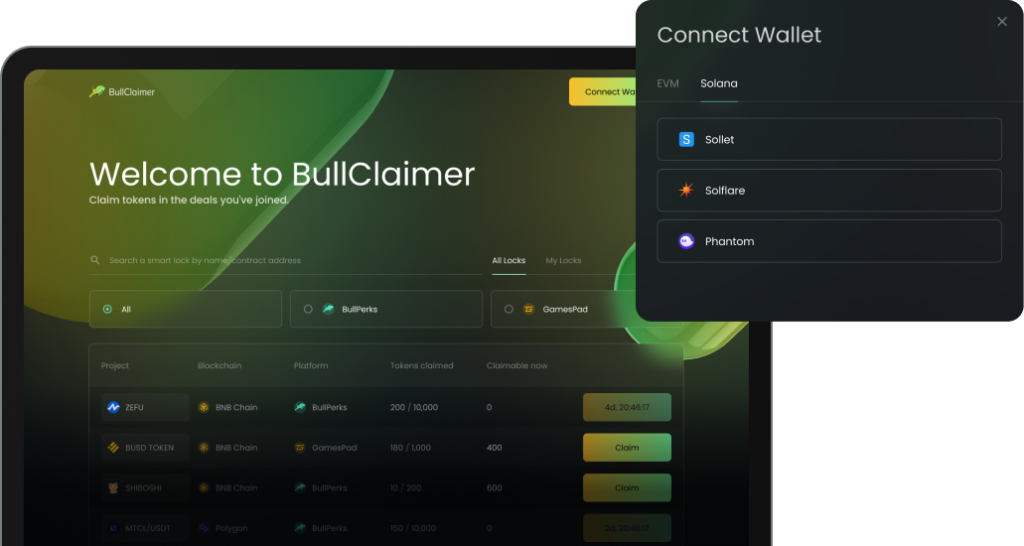

A simple, user-friendly feature allowing you to claim your project tokens after completion of your selected IDO.

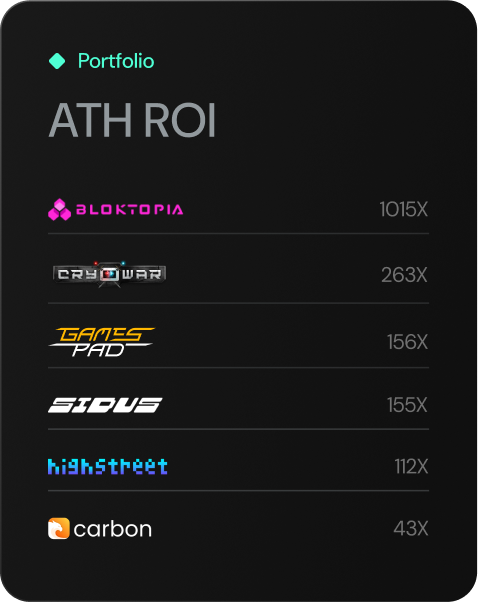

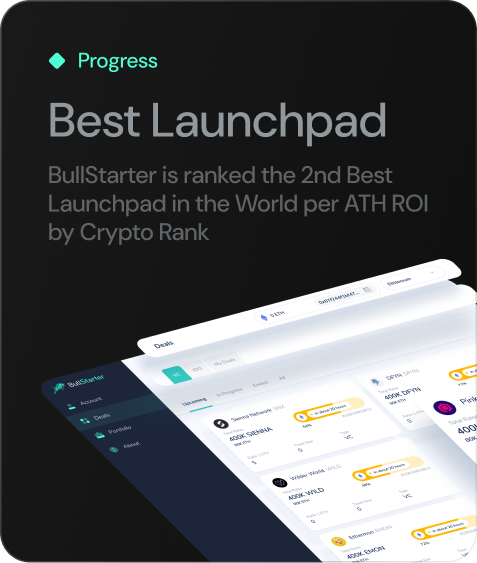

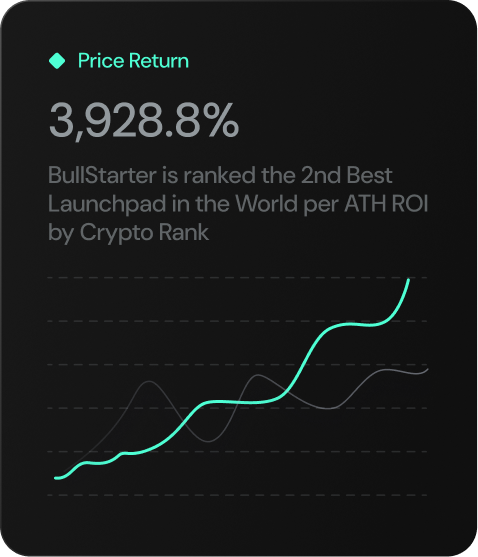

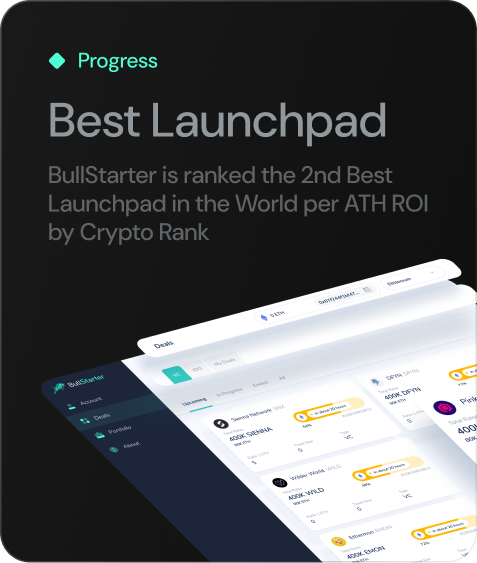

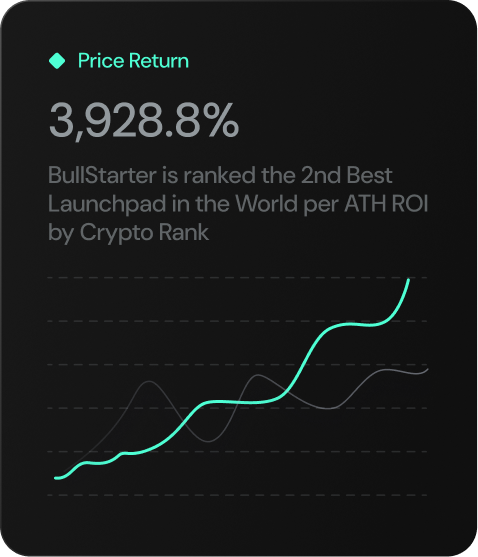

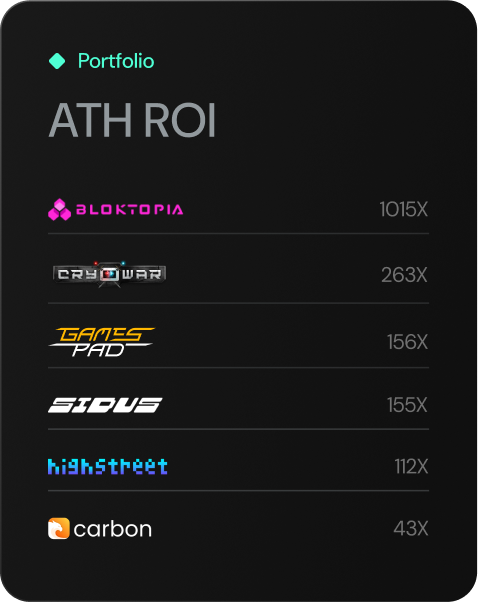

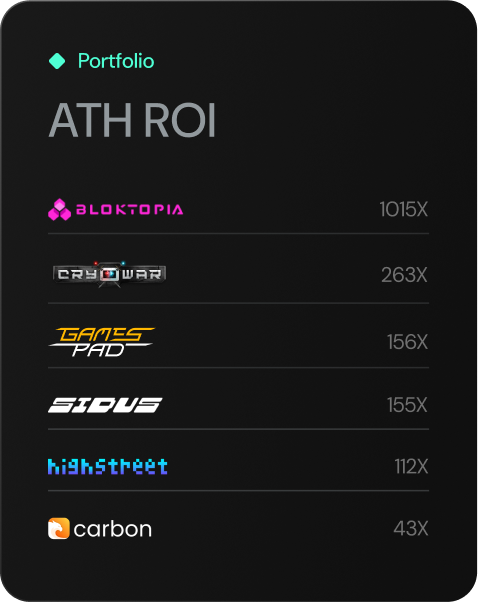

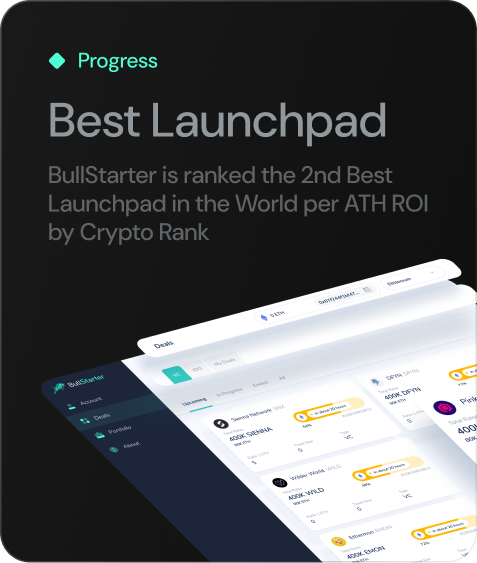

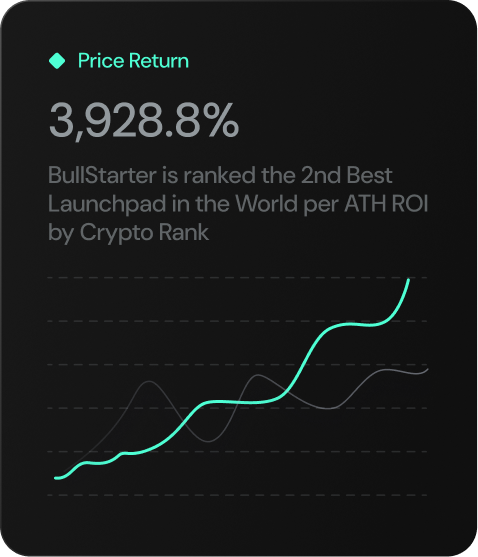

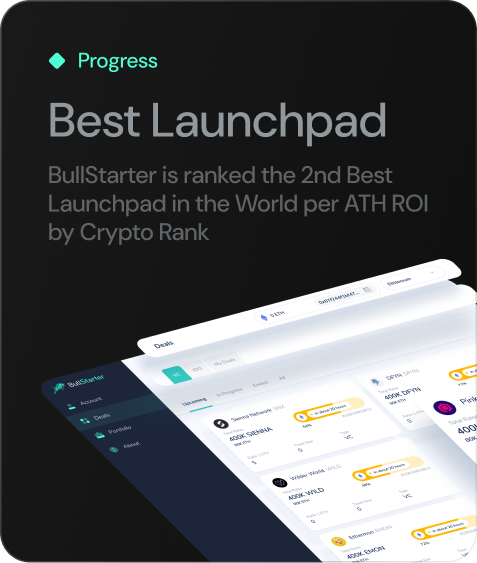

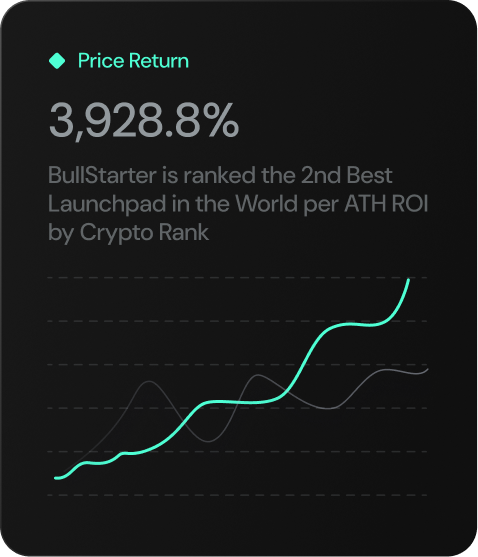

BullStarter is ranked the 2nd Best Launchpad in the World per ATH ROI by Crypto Rank

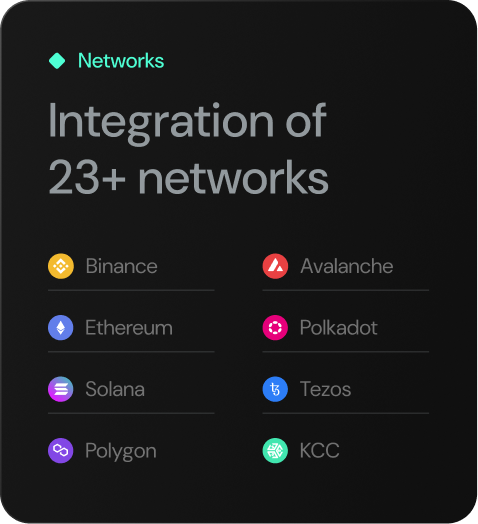

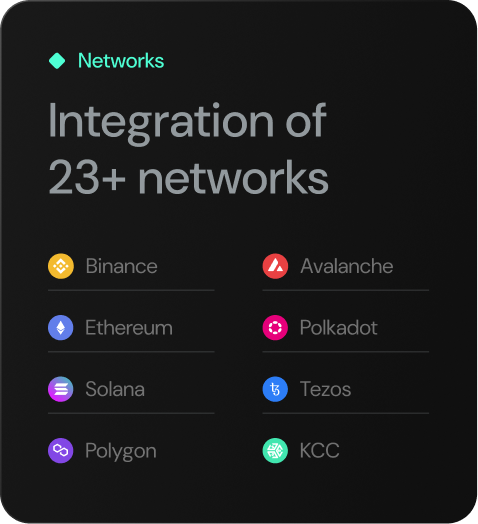

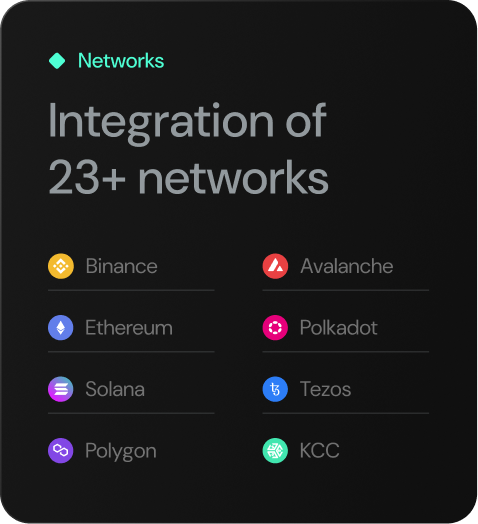

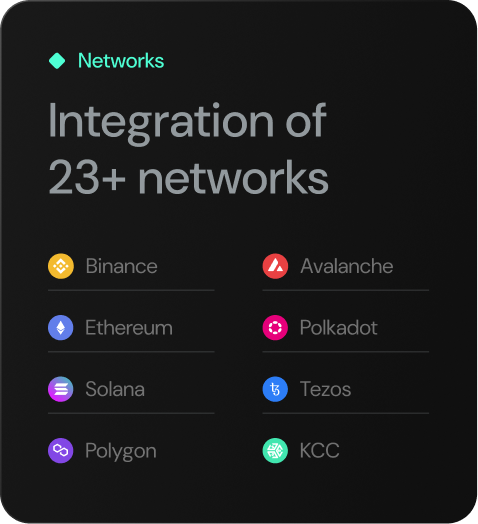

Ethereum

Ethereum

BNB Chain

BNB Chain

Polygon

PolygonA core part of the BullPerks mission is affordability and accessibility in early-stage projects for everyone.

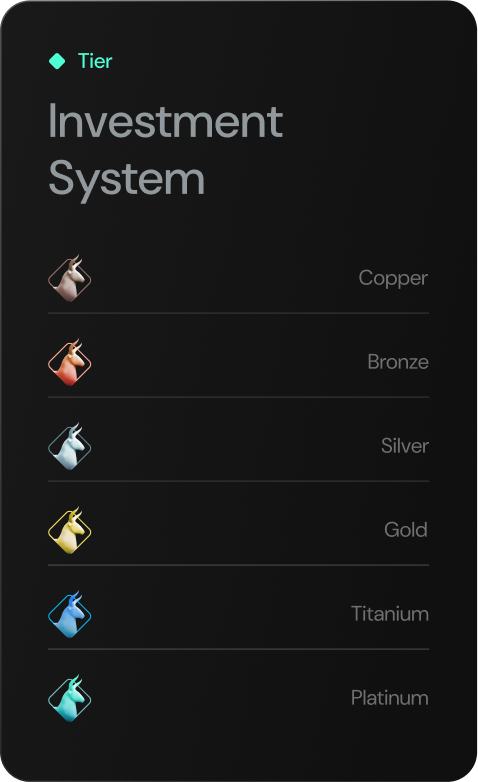

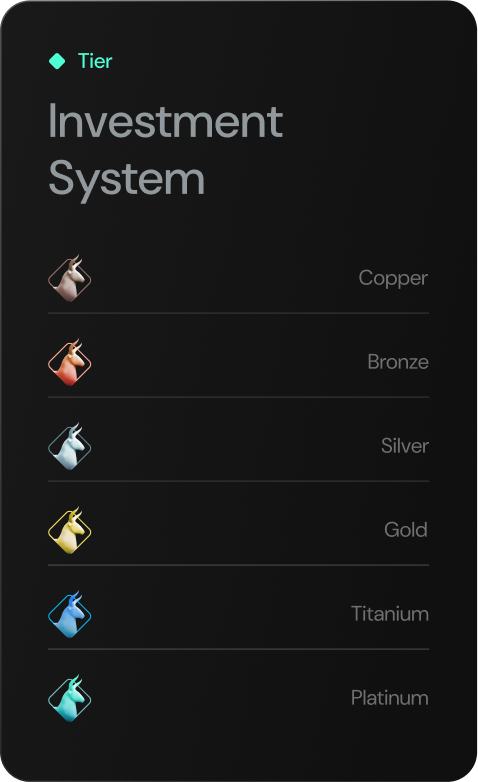

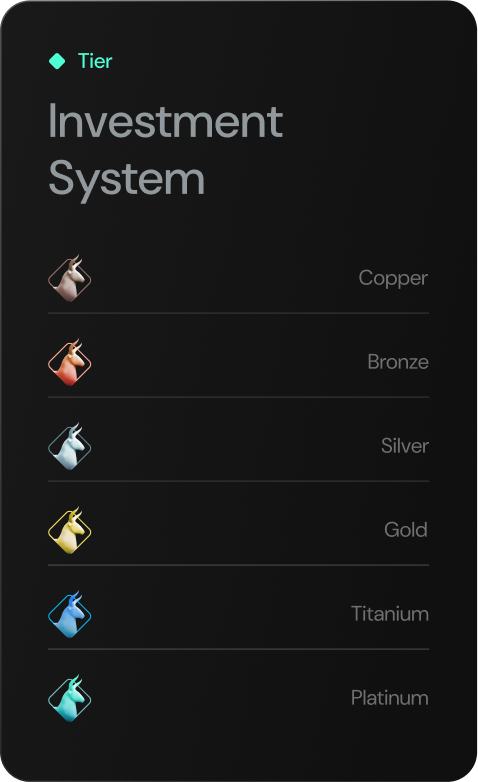

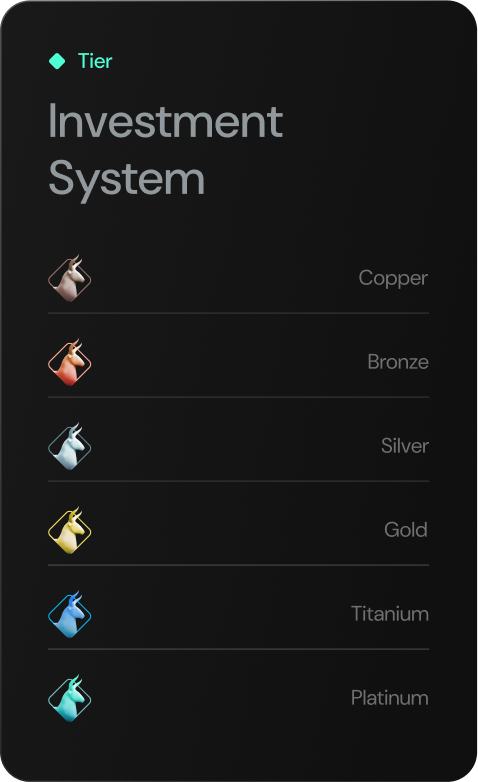

1,500 tokens BLP

5,000 tokens BLP

15,000 tokens BLP

50,000 tokens BLP

125,000 tokens BLP

250,000 tokens BLP

To activate the tier, you should buy, as well as lock/stake/farm BLP tokens on the platform

02