How to Invest In DeFi?

22 Mar, 2022

You might be a senior traditional venture capitalist, a well-educated centralized crypto trader, or even a novice investor looking for the very first opportunity to start your asset portfolio. Regardless of your expertise in investing, getting to know DeFi and learning how to invest in it can put you one step ahead in the investing game.

You might be a senior traditional venture capitalist, a well-educated centralized crypto trader, or even a novice investor looking for the very first opportunity to start your asset portfolio. Regardless of your expertise in investing, getting to know DeFi and learning how to invest in it can put you one step ahead in the investing game.Why to invest in DeFi?

As a matter of fact, DeFi has become one of the most popular topics in the crypto community throughout 2021, and it is set to enter the investing spotlight even further this year as crypto investments are predicted to become more stable, sustainable, and regulated. The rule is simple in the investing world: whoever comes first will be in the front line to receive the rewards. So, you do not want to be late for the DeFi investing race. To help you out on this journey, here we'll discuss what DeFi is and how it works, why investors should keep an eye on this new investing trend, and how you can start investing in it.DeFi: What Is it, and Why Does it Matter?

DeFi is short for Decentralized Finance, a new financial system that uses blockchain technology to supply products and services managed by smart contracts. In turn, blockchains are databases that register transactions without being controlled by a central authority, meaning that they are decentralized.What is DeFi In short?

In short, the DeFi ecosystem is a collection of decentralized applications that execute financial services, resulting in faster, safer, and more transparent transactions, all thanks to blockchain technology. All DeFi products and services work on a peer-to-peer dynamic; for example, there are no intermediaries between sellers and buyers.DeFi vs Traditional Financial Industry

The purpose of DeFi apps is to disrupt the traditional financial industry, where the users are not in control of their own assets. DeFi is decentralized and non-custodial, which is ensured when developers transfer ownership of protocols and programs to users via smart contracts, resulting in community-controlled digital assets, giving users complete control over their coins and tokens. That is why DeFi is so relevant right now. With DeFi, financial transactions are faster, less expensive, more transparent, and more accessible, as no entities are policing, processing, and charging fees along the way. DeFi also makes investing a more democratic maneuver, not asking for a minimum capital amount. It enables average investors to gain access to new and better deals, lower costs, enhance rates, and gain a greater sense of control over their financial strategy.

Invest in DeFi in 3 Steps

From asset management and trading to lending and borrowing, DeFi platforms offer a vast spectrum of financial services that you can invest in and build your crypto portfolio. However, there are three popular investing options that you must watch more closely: buying and selling tokens, interest earning, and yield farming.- Buying and selling tokens

- Yield farming

How to invest in DeFi Step by Step:

1. Prepare a crypto-wallet

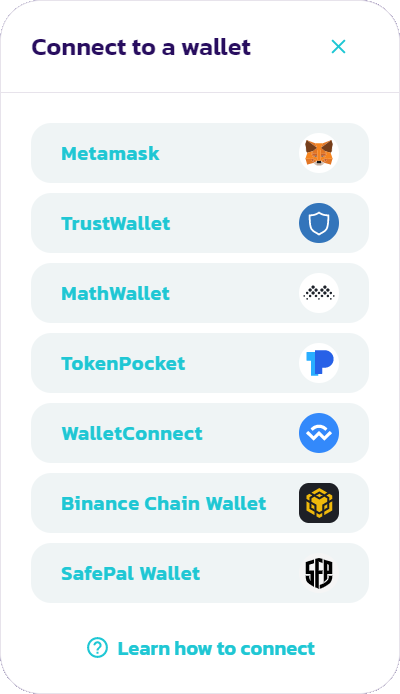

You'll need a crypto wallet to store the crypto coins that you'll need to complete any transaction on DeFi platforms. You will be using the wallet constantly; for that reason, you must choose a crypto wallet that you like and that aligns with your investing goals. It is fundamental to look up the wallet's features, such as which networks and tokens it supports, the security mechanisms, and more. You can check our article "What is a DeFi Wallet?" to understand more about this tool and get to know some popular wallets.

2. Purchase crypto coins

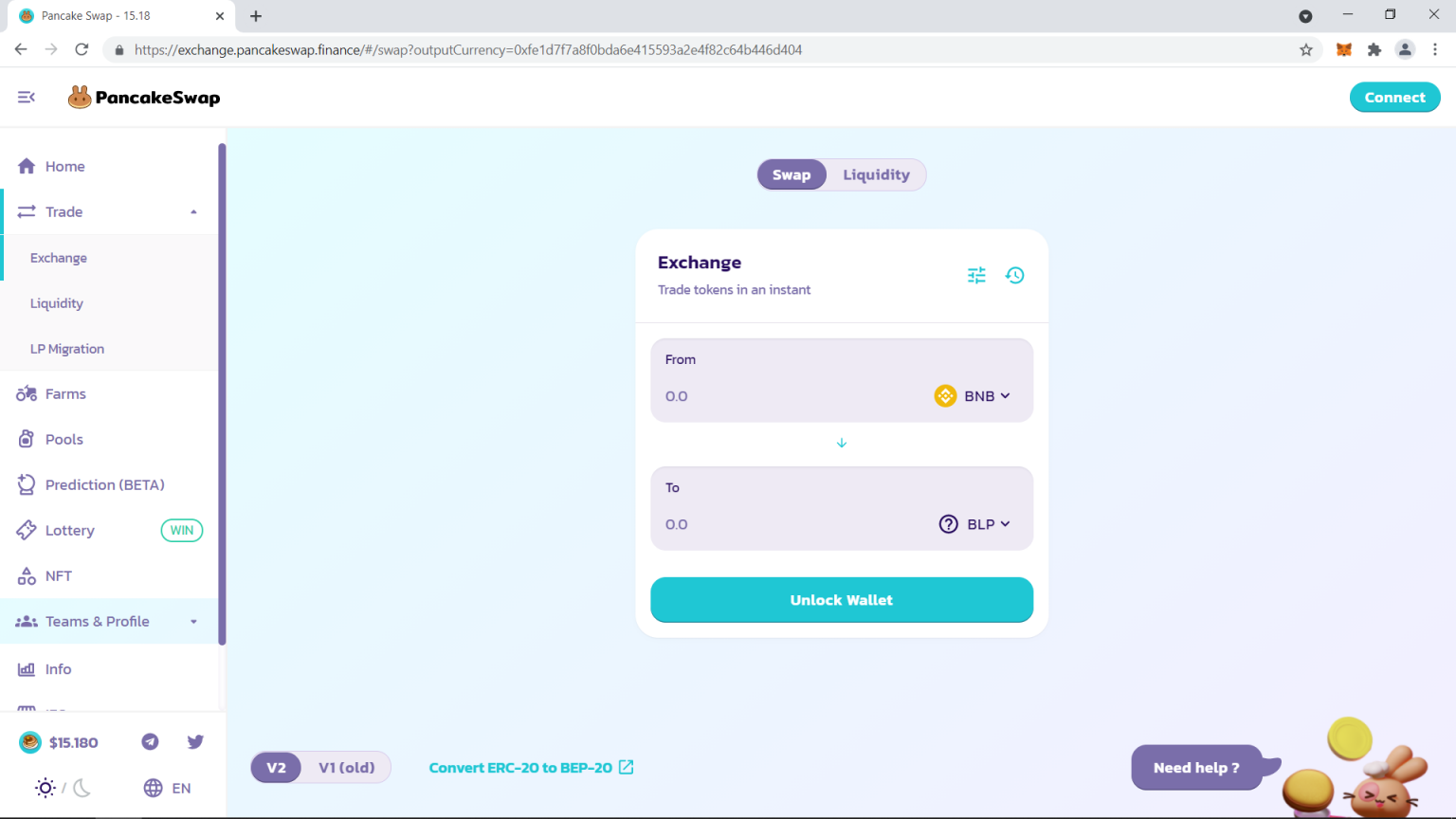

You need crypto coins to invest in DeFi. So, after setting up your crypto wallet, you can buy coins on exchanges. Much like the wallet, you must choose a crypto exchange that meets your investing needs, as there is no one-size-fits-all exchange platform. Some popular exchanges are UniSwap, PancakeSwap, and SushiSwap. In theory, you can buy any coin you want. However, it would be best to keep in mind that the cryptocurrency needs to be compatible with the project or method you want to invest in. Most protocols are built on the Ethereum network, so ETH might be a good coin to start with.

3. Get started with protocols

Several DeFi protocols allow investors to lend, trade, and stake crypto and earn rewards. Some let you participate in liquidity pools and earn when transactions happen in your pool, and others allow the investor to engage in yield farming. Like the previous steps, choosing a suitable protocol depends on your particular goals. After you choose the protocol you want to start with, you'll need to connect your wallet so that the platform can access your coins. Then, each protocol will have specific instructions for each investment method that you must follow. As with any other type of investment, DeFi has its perks and risks. On the one hand, DeFi is an $80 billion industry that puts money control and power back into the users' hands. You won't need to ask permission from anyone or any institution before confirming a trade, and you don't need to associate your identity with your financial transactions. However, acting by impulse may lead to downfalls when investing in DeFi. Wise investors will take their time to learn more about a project and its issuers, making sure they are willing to allocate their capital into a legitimate and secure deal. Investing is all about research! To help you on this quest of finding a promising and solvent DeFi project to invest in, we have gathered the most promising initiatives in the article "Top 7 DeFi Projects to Watch In 2022".How to Invest With BullPerks?

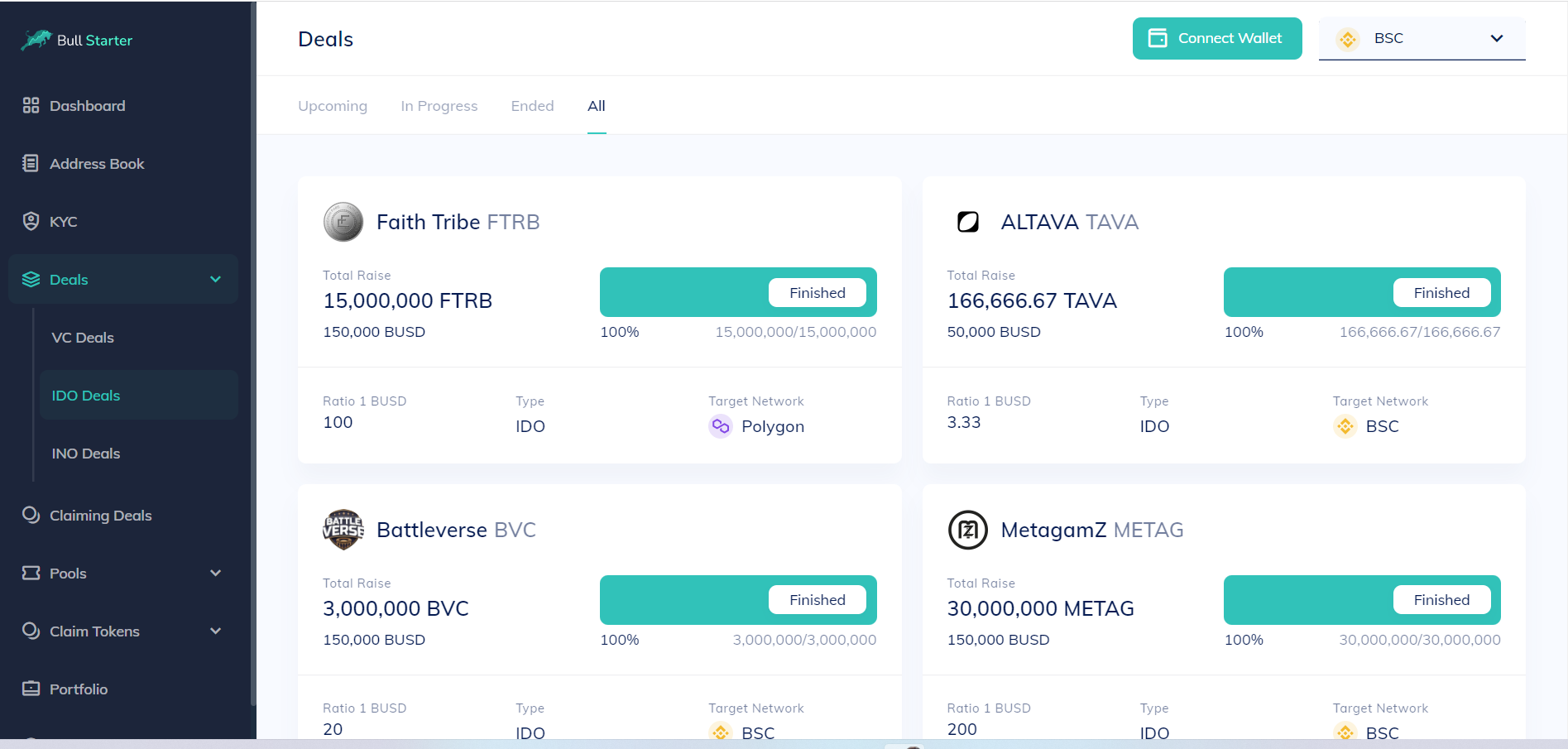

BullPerks is a DeFi ecosystem built on Binance Smart Chain that offers its community the choice to invest in Initial Dex Offerings and Venture Capital deals. The company aims to simplify entrepreneurs' access to investors and provide tools to help liquidity management while also connecting investors with promising and profitable crypto-based projects. Unlike other platforms, BullPerks presents an adaptive tier system, allowing all potential investors to access the best tiers and deals, even when the token price increases. As a result of its community-centered efforts, BullPerks has achieved 9500% of ATH ROI after only six months of operations. Investing with BullPerks is easy. After completing the standard steps of setting up a wallet and buying the coins, you are ready to register on the BullStarter platform and complete the Know Your Customer procedure. Then, you can choose between VC or IDO deals to invest in. The main difference between VC and IDO is that the first are private sales and the second are public sales. After researching the projects, you can join the selected deal.

- We count on an exceptional team of founders and advisors with a proven track record.

- All the projects listed on the BullStarter platform go through rigorous due diligence before being open to our community.

- By investing in the advertising of the projects, we benefit startups and investors as we share trustworthy information about every deal and its background.