The years of 2022 and 2023 have already shown that DeFi tokens will be a trending topic this year. This new financial system is earning its space between novice and senior investors seeking new ventures and among entrepreneurs looking for an opportunity to raise funds for their startups.

It is about time that you get to know DeFi, and here we have explained all the details that will help you make good investing choices. Check it out!

The years of 2022 and 2023 have already shown that DeFi tokens will be a trending topic this year. This new financial system is earning its space between novice and senior investors seeking new ventures and among entrepreneurs looking for an opportunity to raise funds for their startups.

It is about time that you get to know DeFi, and here we have explained all the details that will help you make good investing choices. Check it out!What Is Decentralized Finance?

DeFi or decentralized finance is a financial system that provides products and services built with blockchain technology and governed by smart contracts. Unlike traditional financial institutions, DeFi works without centralized intermediaries or entities and uses open DeFi protocols to execute services programmatically and flexibly. In short, the DeFi ecosystem is a collective of decentralized applications that offer financial services through a blockchain, resulting in faster, safer, and more transparent transactions. Such services include payments, lending, trading, investments, insurance, and asset administration. Decentralized and non-custodial DeFi applications' goal is to disrupt the conventional financial industry. Developers guarantee decentralization by handing over the smart contracts' ownership of protocols and apps to their users, creating community-controlled assets. On the other hand, it is also non-custodial. Users have complete control over their coins and DeFi tokens, unlike traditional institutions that take custody of your assets whenever you need to complete a transaction.

How and Why Was DeFi Developed?

DeFi projects are built on blockchains, decentralized networks with no central institution in control. Blockchains also power the technology that makes DeFi possible, such as DeFi tokens and wallets, smart contracts, DAOs, and the like. The development of DeFi provided alternatives to traditional financial services comparable with the creation of cryptocurrencies as options to fiat currency. DeFi maintains the user in control of their assets and eliminates intermediaries, while CeFi puts the reins on the hands of conventional entities. Decentralized finance also emerged as a more accessible financial outlet for audiences that don't have access to banks or other traditional organizations. It provides those people with high-quality financial services in a more transparent, flexible, and democratic manner, as DeFi doesn't connect identities to transactions. Some Decentralized Exchanges dominating this new space are Uniswap, PancakeSwap, and SushiSwap. While this revolutionary concept is still in its early stages and has yet to be regulated, DeFi holds for token holders much potential as the foundation for a more efficient, adaptable, and egalitarian financial future.DeFi Coins vs. DeFi Tokens

As DeFi is a dimension of the crypto market cap, the concept of coins and DeFi tokens is inseparable from decentralized finance. While some may think that both words have the same meaning, crypto coins and crypto DeFi tokens are, in fact, different. Such a difference even creates a fun riddle: all coins are DeFi tokens, but not all DeFi tokens are coins. How does that work? A DeFi coin, like Bitcoin, works as a digital interpretation of fiat coins, transferring value through a decentralized financial transaction. They operate on their own blockchain networks, which keep track of all coin transactions. A coin can also be mined, meaning that experts can create new digital currency units through Proof of Work or Proof of Stake.

Why Investors Are Turning to DeFi

Decentralized Finance (DeFi) has revolutionized the financial industry, providing a new approach to traditional financial systems. It enables peer-to-peer transactions eliminating the need for intermediaries such as banks or brokers. Here are some reasons why many investors are turning to DeFi:- Access to New Asset Types: DeFi allows everyday investors to explore new types of assets that were previously unavailable or difficult to access.

- Reduced Fees: Traditional financial institutions often charge hefty fees for their services. DeFi can significantly reduce these costs by eliminating intermediaries.

- Improved Rates: DeFi platforms often offer better interest rates compared with traditional financial institutions. This is particularly true in areas like lending and staking.

- Increased Control: DeFi gives users more control over their financial decisions. They can choose where to invest, how much risk to take, and have direct access to their funds without third-party interference.

- Innovation and Security: The DeFi sector continues to innovate, appealing to both retail and institutional investors. Many DeFi projects have also undergone thorough smart contract audits by reputable firms, making them more secure.

- Yield Farming: Yield farming is one of the most popular ways to invest in DeFi. It involves lending out cryptocurrencies in exchange for interest in the form of additional tokens.

How to Start Investing in DeFi

Now that you know the principles and basic concepts of DeFi, it is time to learn how to invest in it through the lending and borrowing dynamic. Many DeFi protocols and platforms support this investing process, so we'll be using BullPerks' system as the guideline to make the instructions more precise.1. Set Up Your Wallet

You'll use your crypto wallet to store, transfer, and receive best DeFi coins. Wallets come with various structures, and some are even linked to exchanges where you can buy coins. To use BullPerks' platform, you'll need a MetaMask wallet. You can then add the Binance Smart Chain to your networks and create a DeFi space for BLP DeFi tokens. Learn more about how to set up your MetaMask wallet here.2. Purchase DeFi Coins

The coin you'll invest in depends on the DeFi protocol you want to participate in. BullPerks is built on the BSC network, so you'll need BNB coins. You can buy BNB coins directly on Binance Exchange.3. Take Part in the Protocol of Choice

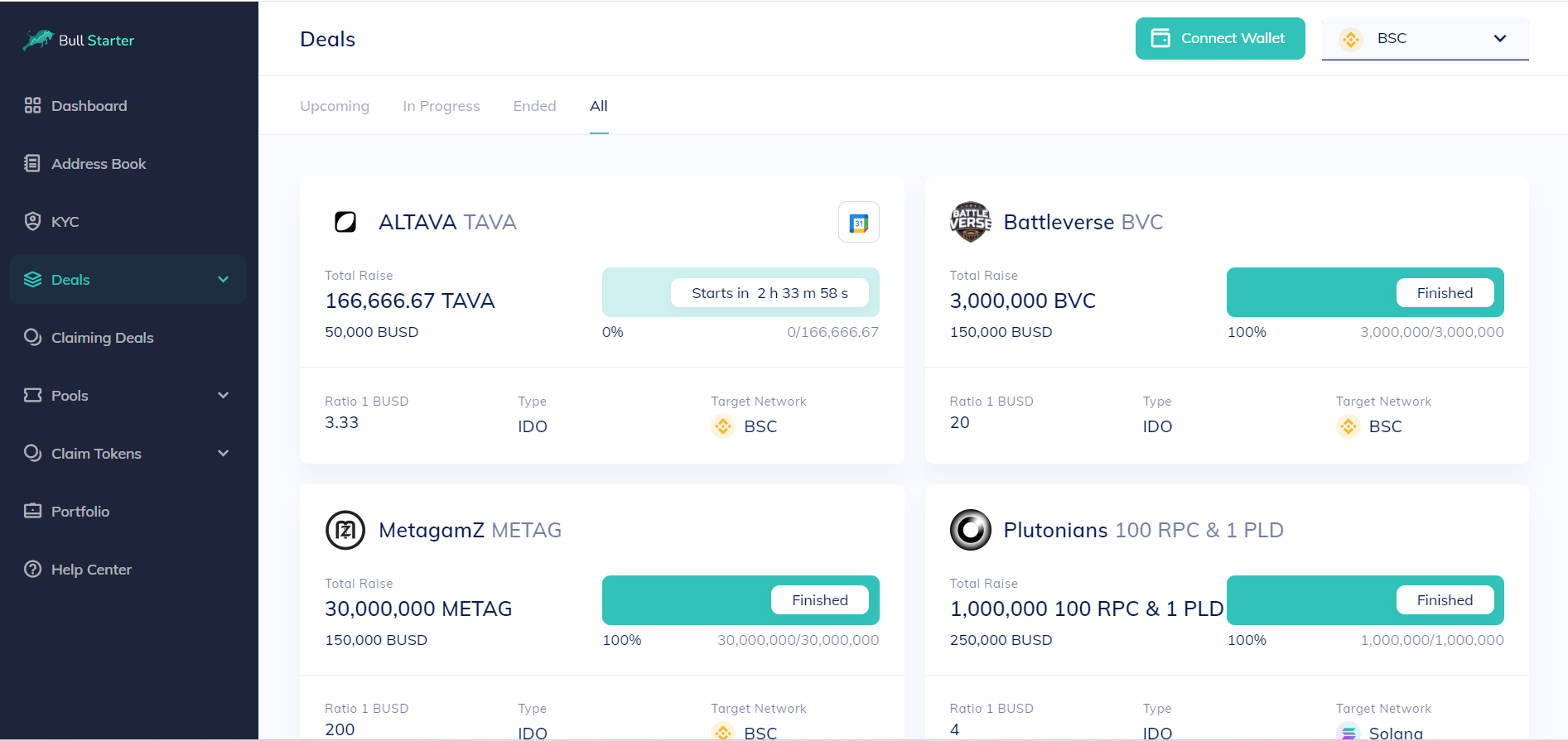

DeFi relies on lending and borrowing just as much as the traditional financial system. However, one of the advantages of DeFi is that it allows users to borrow and lend assets while maintaining custody of their DeFi coins. With BullPerks, you can invest through fundraising by participating in a VC or IDO deal, or you support crypto-based initiatives by buying their tokens. The DeFi platforms list only the top promising projects, and you can invest in any of them anonymously in a secure space.

Top 5 DeFi Coins in 2023

In 2023, the DeFi (Decentralized Finance) space continues to grow with several coins standing out as top investment opportunities. Here are the top five DeFi coins in 2023:

Uniswap (UNI)

Uniswap is a popular decentralized trading protocol known for its role in facilitating automated trading of decentralized finance tokens. It has emerged as one of the top DeFi coins due to its innovative features and significant user base.Chainlink (LINK)

Chainlink is a decentralized oracle network that enables smart contracts on Ethereum to securely connect to external data sources, APIs, and payment systems. LINK, the native token of Chainlink, is essential for the overall functioning of the Chainlink network.Avalanche (AVAX)

Avalanche is a high-performance, scalable, customizable, and secure blockchain platform. AVAX, the native token of Avalanche, is used for fees, staking, and providing a basic unit of account between the multiple subnets in the Avalanche system.Lido (LDO)

Lido is a liquid staking solution for ETH 2.0. Lido lets users stake their ETH - contributing to the security of the Ethereum network - while still having access to a liquid token.MakerDAO (MKR)

MakerDAO is a decentralized credit platform on Ethereum that supports Dai, a stablecoin whose value is pegged to USD. MKR is a governance token in the MakerDAO system. These coins have been recognized for their robust technology, strong community support, and significant potential for future growth. However, investing in cryptocurrency carries risk, and prospective investors should conduct their own research or consult with a financial advisor.Bottomline

DeFi is on the rise, and so are the coins emerging during the early stages of this new financial system. Investing in this modality right now may bring highly profitable returns in the near future. However, it is essential to conduct an extensive study on DeFi protocols, exchanges, and coins before allocating your money to any initiative. It is also crucial to be confident about which investment technique you will be using, such as crowdfunding, lending, borrowing, or waiting for a token to increase value.Do you now know "why invest in DeFi coins and token?" We hope the answer is "yes," and you have learned more about Decentralized Finance, DeFi coins, crypto coins, DeFi projects, crypto assets, DeFi apps, and more. Check out our BullPerks blog to become familiar with such terms as a blockchain network, a native token, a governance token, asset tokens, crypto world in general, fiat money, how to pay transaction fees, a decentralized network, how to sell crypto, transfer funds, about the best DeFi tokens, network security, how to choose the best crypto exchange and the best DeFi project, and so much more.

Would you like to start investing in the most promising crypto projects? Learn how to invest with BullPerks, the fairest and most community-oriented decentralized VC and multichain launchpad!