How Are My Crypto Mining Income And Staking Rewards Taxed?

01 Apr, 2022

Crypto is no longer a no-man’s-land: learn more about worldwide taxation guidelines for mining and staking, and prepare yourself for the expenses before investing. The hype surrounding crypto-based investments and their potential to provide high profits is non-precedent. Online and offline groups can't stop talking about token purchasing, mining, staking, and farming, but what everybody often forgets is whether their newly earned income will be taxed or not and how much tax agencies are willing to collect from them.

In this article, we'll zoom in on the taxation of mining income and staking rewards, understanding what major institutions and governments are saying about it and how you can prepare yourself. Let's dive in!

Crypto is no longer a no-man’s-land: learn more about worldwide taxation guidelines for mining and staking, and prepare yourself for the expenses before investing. The hype surrounding crypto-based investments and their potential to provide high profits is non-precedent. Online and offline groups can't stop talking about token purchasing, mining, staking, and farming, but what everybody often forgets is whether their newly earned income will be taxed or not and how much tax agencies are willing to collect from them.

In this article, we'll zoom in on the taxation of mining income and staking rewards, understanding what major institutions and governments are saying about it and how you can prepare yourself. Let's dive in!What Is Crypto Staking?

When people think about investing in cryptocurrencies, they usually have in mind mining or buying them on an exchange. However, staking is another option to include passive income in one's crypto investing portfolio. Crypto staking consists in locking up coins in a liquidity pool to earn rewards. The technical logic behind this strategy is that cryptocurrencies depend on blockchains, which need verification methods to validate every transaction and store data on the chain. Some of the most significant benefits of staking are:- Potential for reasonably high returns, considering the cryptocurrency and the pool's annual percentage yield.

- No need for highly-efficient equipment or computational power.

- Playing an essential part in a project the investor believes in.

How Are Staking Rewards Taxed?

Because of the lack of regulations regarding the taxation of crypto staking, taxpayers worldwide are applying their own understanding of how token earnings should be taxed. Some claim that stakers execute services when validating blocks, so the tokens should be understood as ordinary income and taxed upon receipt. Others see staking earnings as a return on investment, meaning the tokens should only be taxed when sold. This discussion has been recently furthered in the US, with the IRS conceding a lawsuit filed by Joshua and Jessica Jarret, in which they asked for a refund of taxes paid in 2019 over income earned through staking. While the refunding may have seemed like good news and a possible sign that staking would be free of taxes, the truth is that the institution decided it was simply not worth their time. This case only shows that the issue of taxing staking rewards has still to be directly addressed. Until then, the U.S.-based investors can take the Notice 2014-21 as an example, as the document treats mining and the receipt of coins in exchange for services as ordinary income, taxed upon receipt. With this regulation, miners also acknowledge capital gain or loss when the coins are sold.Which countries tax staking?

Like the US, many countries are still taking the first steps to regulate the taxation of crypto investments. Here are some countries that already have some guidelines for taxes: The United Kingdom: According to CoinDesk, a recent update of the UK's tax agency states that staking taxation depends on whether the returns will be considered a capital asset or revenue. If considered a capital asset, earnings higher than £12,300 will be taxed 10% for basic rate taxpayers. Italy: While Italy has yet to create a specific law to regulate cryptocurrency taxation, Italian authorities currently understand cryptocurrencies as foreign currency, meaning that any proceeds or income earned between or from crypto-based activities are subject to 26% substitutive tax, as explained by The Cryptonomist. Canada: As clarified in the official statement, this country treats cryptocurrency as a digital asset, and staking rewards are considered income, being taxed upon the coins' sale. In this case, the investor must consider the fair market value of the crypto and the Federal and Provincial Income Tax rates when calculating. Germany: Unlike the countries mentioned before, Germany identifies cryptocurrencies as private money, meaning that coins must be held for at least one year to be tax-free. This holding period goes up to 10 years for staked crypto, as seen in Indian Times. Before that, any transaction over €600 is subject to taxes.Staking on BullPerks

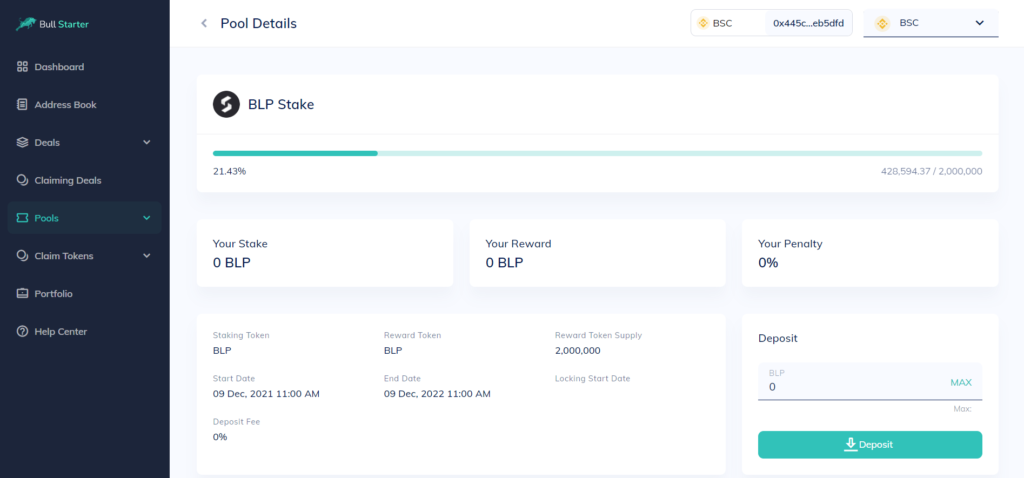

As staking is showing to be a profitable form of crypto-based passive income, BullPerks decided to offer this opportunity on its platform to keep up to date with investors' preferences. We care deeply for our users' experience, so we have prepared an interface that makes it easy for investors to decide which pool they want to stake their coins in. Later, they can calculate the earnings effortlessly to file their income correctly and pay the associated taxes. Here is how you can stake your coins with BullPerks:- Purchase BLP on decentralized exchanges and transfer it to your wallet. We recommend the MetaMask wallet.

- Go to your BullStarter account and access the Staking Pools page.

- Select a stacking pool and then click Deposit to enter the number of tokens you desire to stake.