Find out more about how crypto staking works and what are its associated risks, and save money by choosing reliable staking platforms.

Cryptocurrency staking is gaining traction as a method for generating passive income by committing a portion of one's assets as collateral. This is viewed by many investors as a way to potentially earn additional income rather than letting their assets idle in cryptocurrency wallets.

Nonetheless, certain governments, including those of the UK and China, have issued warnings to their citizens regarding the risks associated with cryptocurrency investments. The volatile and deregulated nature of the crypto sphere necessitates that investors understand the inherent risks of staking before engaging.

In this section, you will discover comprehensive insights about what staking entails, its operational dynamics, and the associated risks. Dive in to learn more!

Risks of staking crypto in short words:

Staking comes with its own set of distinctive, and potentially more detrimental, risks: slashing and penalties. During the staking process, investors are mandated to validate transactions using their validator keys.

But let is see in the details:

Top 5 risks to understand before staking cryptocurrency

While staking may present higher earnings compared to conventional passive income investment approaches, it also carries inherent risks. It's prudent to acquaint yourself with the hazards of staking, and to aid in this, we have compiled the most notable risks for your attention. Take a look!

1. Impermanent loss

The cryptocurrency market is intrinsically extremely volatile, which implies that token values can sway drastically within a few hours. When staking, individuals contribute liquidity to the pool, which can be distressing if the value of the staked coin diminishes during the staking duration, as this could lead to substantial financial loss.

2. Crypto token lockup periods

Throughout the term of your staking, the funds you've staked will be locked and thus inaccessible. Therefore, if you have a change of heart about staking your coins, require them for any reason, or notice a value increase that makes trading them a more favorable option, retrieving them won't be swift or simple — in fact, withdrawing them before the lockup period concludes can incur penalties.

3. Potential illiquidity of crypto token

A crypto platform's liquidity is determined by an asset's capacity to be converted into fiat money or other cryptocurrencies. If the investor takes a token with a small market capitalization, there can be a lack of liquidity, affecting the trade of the staking rewards afterward.

4. Crypto Theft

Crypto theft has increased alongside blockchain technology's popularity. Although some exchanges might claim that staked coins are secured in cold storage, sometimes that isn't the case. Technical faults and breaches can leave staked assets vulnerable, and investors can lose their funds and rewards.

5. Validator mistakes

As mentioned before, becoming a validator on your own is a highly technical and challenging task but also offers higher returns compared to staking pools and exchanges. However, if solo validators make mistakes during the validating process, they might not be rewarded at all, and staking won't be worth the labor.

Staking on BullPerks

BullPerks offers staking pools on the BullStarter platform to provide yet another investment modality for our community. We are determined to present pools with attractive annual percentage yield rates and low fees while ensuring financial and data-wise security for your investments.

When staking with BullPerks, you give a profitable purpose for the coins that would otherwise be sitting with no use in your crypto wallet. By locking them up, you also become eligible to participate in any of our IDO deals. Here's how you can get started with staking on the BullStarter platform:

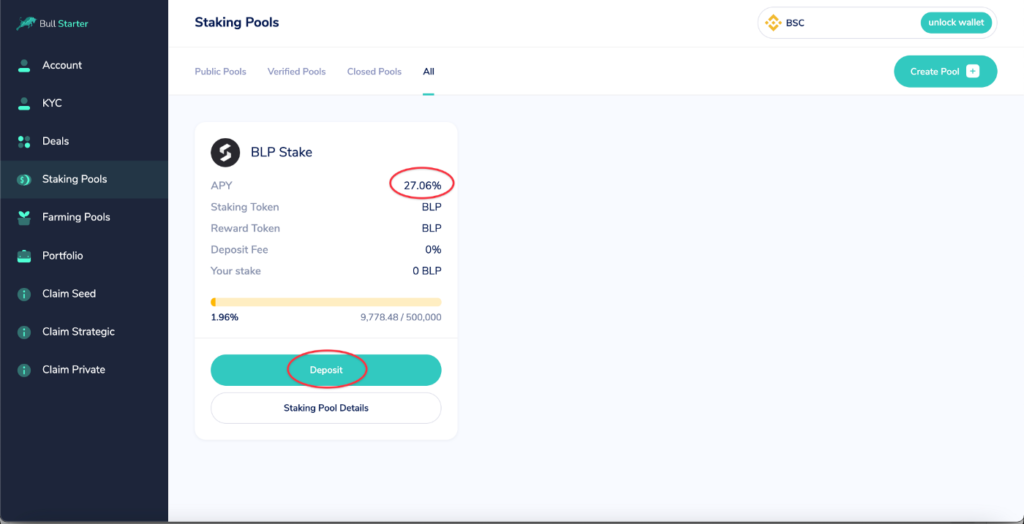

- Go to your account and look for the Staking Pools page.

- On this page, you'll be able to see the Deposit option and check relevant information, such as the APY rate of the pool. Click on Deposit.

- Soon after, you'll be shown a window to write down the number of tokens you wish to stake. Click on Approve and Confirm.

- After confirming the transaction on the platform, your connected wallet might ask for double confirmation. Confirm again.

- Great! You have staked your tokens on the selected pool, and your rewards will be available after the lockup period.

Read more about staking on BullPerks here.

Final Thoughts

Staking provides a stable passive income for thousands of people worldwide, but it requires patience and is not without danger. Thinking about each of its associated risks stated above before staking your crypto might wind up saving you a lot of money.

Would you like to start investing in the most promising crypto projects? Learn how to invest with BullPerks, the fairest and most community-oriented decentralized VC and multichain launchpad!

Disclaimer. This material should not be construed as a basis for making investment decisions or as a recommendation to participate in investment transactions. Trading digital assets may involve significant risks and can result in the loss of invested capital. Therefore, you must ensure that you fully understand the risk involved, consider your level of experience, investment objectives, and seek independent financial advice if necessary.