- Welcome to the exciting world of cryptocurrencies! As you navigate your way through this rapidly evolving landscape, you may have come across the term "IDO" or Initial DEX Offering. If you're scratching your head wondering what that is, don't worry! We've got you covered.

- This article is your one-stop-shop for understanding IDOs, breaking down complex concepts into bite-sized, digestible information. So buckle up and get ready to embark on an enlightening journey into the fascinating realm of Initial DEX Offerings. Whether you're a crypto novice or an experienced trader, there's something in here for everyone. Let's dive in!

What is IDO in crypto?

An Initial DEX Offering (IDO) is a type of crowdfunding that allows cryptocurrency projects to raise funds by selling their native tokens on a decentralized exchange (DEX). IDOs are a newer form of crowdfunding than Initial Coin Offerings (ICOs), and they offer a number of advantages over ICOs, including:

- Decentralization: IDOs are conducted on decentralized exchanges, which means that they are not subject to the same level of regulation as ICOs. This makes them more appealing to investors who are concerned about the security of their funds.

- Transparency: IDOs are more transparent than ICOs because they are conducted on public blockchains. This means that investors can easily verify the information about the project and the team behind it.

- Efficiency: IDOs are more efficient than ICOs because they can be conducted more quickly and easily. This is because they do not require the approval of a centralized exchange.

IDOs have become increasingly popular in recent years, and they are now a major source of funding for cryptocurrency projects. If you are interested in investing in an IDO, it is important to do your research and choose a project that you believe in.

Why do crypto projects consider initial decentralized exchange offerings?

The crypto market has been changing over time. No one could imagine that within slightly over a decade, Bitcoin, once worth just above zero, would have its value increased to around $60,000. Now, the crypto community can only avoid making the mistake of not getting newly created crypto tokens with perspectives right into a crypto wallet.

But now, picking new tokens that represent new projects is a complicated task. The number of scam projects has increased, and it looks at times when everybody launches a token sale in the hope of getting some quick money.

That's why we recommend you to do your own research, check who the project developers are, the total token supply, and what are the project's distinct advantages compared to competitors; and only then you can consider investing in a crypto token offering run.

Initial Exchange Offerings are booming now

One of the crypto-based investment sensations right now is the IDO model. This new native token offering modality debuted in 2019 when Raven Protocol listed its IDO on Binance DEX. But it was only in 2021 that the IDO model gained massive popularity, with the consolidation of decentralized finance and the arrival of several decentralized exchange launchpad platforms.

There is still time to become an early investor in a crypto IDO. To help you in this new venture, we have prepared an in-depth guide to show you all the details about joining an IDO deal. Check it out!

How Does IDO Work?

In an IDO, the project's token is listed directly on a decentralized liquidity exchange (DEX) which lowers the listing costs due to its decentralized nature compared to a token offering on centralized exchanges or an initial public offering.

IDOs tend to sell out quickly, allowing a project to be developed soon after its deal launch, which makes them a good fundraising method. Investors can access instant token trading immediately because immediate liquidity is provided.

Anyone can launch a new token provided he can handle some marketing tasks and has the required technical knowledge.

An Initial DEX Offering (IDO) is a type of token sale that takes place on a decentralized exchange (DEX). IDOs are a newer form of crowdfunding than Initial Coin Offerings (ICOs), and they offer a number of advantages over ICOs, including:

- Decentralization: IDOs are conducted on decentralized exchanges, which means that they are not subject to the same level of regulation as ICOs. This makes them more appealing to investors who are concerned about the security of their funds.

- Transparency: IDOs are more transparent than ICOs because they are conducted on public blockchains. This means that investors can easily verify the information about the project and the team behind it.

- Efficiency: IDOs are more efficient than ICOs because they can be conducted more quickly and easily. This is because they do not require the approval of a centralized exchange.

Here is a step-by-step guide on how an IDO works:

- The project team creates a whitepaper that outlines the project's goals, team, and tokenomics.

- The project team conducts a pre-IDO marketing campaign to generate interest in the project.

- The project team launches the IDO on a decentralized exchange.

- Investors can purchase tokens using cryptocurrency.

- The project team distributes the tokens to investors.

IDOs have become increasingly popular in recent years, and they are now a major source of funding for cryptocurrency projects. If you are interested in investing in an IDO, it is important to do your research and choose a project that you believe in.

Here are some things to keep in mind when investing in an IDO:

- Do your research: Before investing in any IDO, it is important to do your research and understand the project. This includes reading the whitepaper, understanding the team's background, and evaluating the tokenomics.

- Invest only what you can afford to lose: IDOs are a high-risk investment, so it is important to only invest what you can afford to lose.

- Be patient: IDOs can be volatile, so it is important to be patient and hold your tokens for the long term.

IDOs can be a great way to get involved in the early stages of a promising cryptocurrency project. However, it is important to do your research and understand the risks involved before investing.

Popular blockchain projects opt for raising funds through token offerings on decentralized exchanges. The majority of cryptocurrency projects center around DeFi, metaverse, NFTs, and gaming. Get to know some popular deals available right now:

- Plutonians: a metaverse space strategy game that blends strategy RPG, action shooter, multiplayer PvE, and social games in an alternate reality.

- BattleVerse: a free P2E online game where users can earn money by playing and developing along with the Universe.

- MetagamZ: a metaverse where game creators can build and launch games with Defi features.

How to Participate in an IDO?

Every IDO launchpad will have specific steps and requirements for an investor to join an IDO deal. Here you'll learn the basics using BullPerks as an example.

Before IDO

There are some tasks an investor must complete before joining a deal, including buying tokens and staking them.

- Set up your MetaMask wallet.

- After logging in or creating an account, you must go to Settings > Networks and the BNB Chain. When you create an account in MetaMask, only the Ethereum network is available from the get-go, you need to add the BNB Chain manually. The instructions on how to do that can be found in this article.

- Then, click on Add Token and copy the token address info to create a space for BLP tokens in your wallet.

You can find BNB Chain network connection info here.

- Purchase BLP tokens on PancakeSwap DEX.

- You must select a crypto pair and confirm the swap. Add the contract address to add BLP as an option.

- After the transaction, PancakeSwap will offer you to view your transaction and add BLP to MetaMask. Then, you will be able to check your purchase in your wallet.

- Register on BullStarter and complete the Know Your Customer procedure.

- To ensure the safety of every deal, BullStarter requires that every user completes a KYC process. After your registration, the system will guide you to complete the KYC, and it takes less than 3 minutes!

- Lock your tokens.

Locking or staking the tokens is a means of being eligible to participate in our deals.

- To do so, you must know how many tokens you need to lock for a specific deal. Then, go to the Account menu, click on Lock-in, select the number of tokens and click on Lock. Confirm the transaction on MetaMask.

This step will determine your tier, which will later influence your profits.

Joining a pool

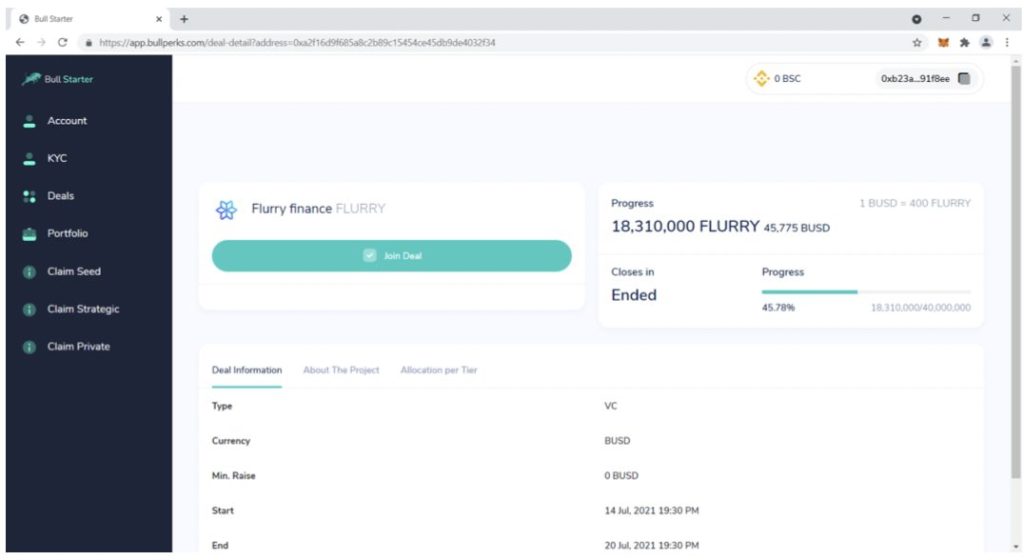

After the preparation steps, you choose a project and participate in an IDO deal.

- Choose a deal.

- On the Deals menu, you can check all the available projects.

- It is essential to learn more about the deals before joining them, and you can do so by reading the articles published on BullPerks' Medium, where each initiative is described in detail.

- Join the deal.

- After choosing the deal and learning everything about it, you can click on Join Deal.

- To invest USDT in the deal, you need to approve your MetaMask wallet by pasting its main account address on the Target Network line. Click on Approve, confirm the transaction, then click on Pay.

How to Earn Money From IDO?

Investors can get their tokens after they are listed on a decentralized exchange.

Either way, the investor will be receiving returns on their investments, but it is wise to analyze the token performance after listing and then decide which earning method they'll choose.

Claiming tokens

After the vesting period, you have access to token distribution according to your tier allocation.

- Open the deal's details on your Portfolio. You can check all the information about the deal on the Portfolio and click on Claim your vested tokens to redeem your earnings.

- After confirming the transaction in your wallet of choice, you will see the confirmation of the transaction submission with the tokens appearing in your wallet shortly after.

Diving deep into the world of crypto investing can be a huge success or failure if the investors aren't aware of the associated risks. Learn more about IDO investment risks and how to avoid them.

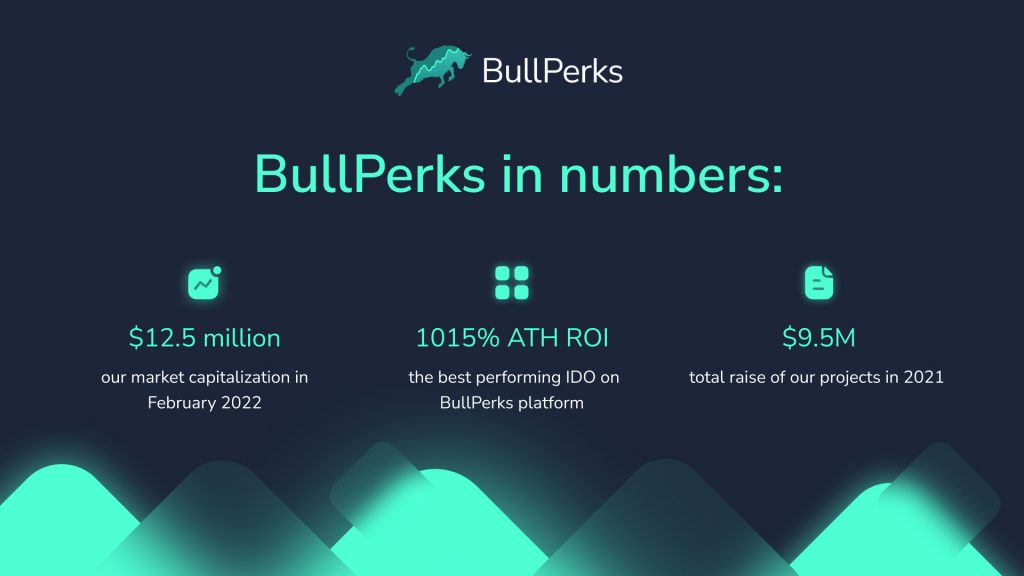

IDOs are becoming an all-time favorite among crypto investors for their transparent investing process and extensive portfolio of promising projects. In fact, this new investment modality is so popular that the best IDO fundraising performance of 2021 reached 127 times its token price.

How to Analyze IDO Projects

Like every high-risk investment, crypto-based projects have their own failure rate in the long term, as some initiatives cannot sustain their popularity. While IDOs have shown to be fairly safer than their precedent coin offerings, every investor must still research each project before buying its tokens.

A promising project will have a reliable team behind it. Usually, many project team members won't have much experience in the crypto industry, but their previous jobs and track can give clues on how they will deliver a project. On the other hand, the advisors also play a massive part in the project's success and must be a group of academics, entrepreneurs, or executives that can guide the startup.

Another staff-related variable to consider is the developers. As high-end blockchain developers are still lacking, a project that bears a dedicated developer is more likely to thrive.

Having an engaged and positive community is also a green flag. The activity level on different social media can indicate its community's adoption and use of the project. A great example of the community's influence on project success is Dogecoin, a memecoin that continues to grow in value every day.

Looking into the project's team profile and community activity is a good strategy to start your due diligence.

Are there any risks associated with investing in an IDO?

Before investing in IDO, you must understand the most common associated risks to make wise choices to invest your money. Here is what you should know:

Lack of control: Liquidity exchanges weren't built specifically to make IDOs work. As a result, project founders have less control over the fundraising. This lack of control can lead to some issues, such as the fluctuation of the token price after the first trade.

Unfair prices: Due to the price fluctuation, only a few early investors are able to purchase a token at the listed price. Thus, those traders might take advantage of the shifting prices to buy tokens in bulk or even develop trading bots to resell the tokens at an exorbitant price.

Liquidity scams: To participate in an IDO, investors must act quickly, which often leads to poor decisions. Scammers take advantage of that by listing phony tokens that seem legitimate. As soon as they gain some liquidity, they withdraw ETH from the liquidity pool and leave investors with fake tokens.

Decrease in value: Like any other crypto-based investment, IDO tokens are susceptible to a decline in value after their listing. That can happen for many reasons, from the project's diminished popularity to some external event affecting the tokenomics. Investors must watch the token movement to figure out the right time to trade.

Why can projects be refunded?

Because scammers are constantly evolving their means to deceive investors and launchpads, sometimes they manage to keep the act up until they are listed.

In those cases, if the launchpad later acknowledges the scam or if the project doesn't reach the minimum raise, the platform can offer a refund to all the investors. That way, the community suffers minor damage from the scam.

However, refunds are exceptional cases. You won't be refunded when you buy a token and regret it later. So, do your research and be sure of your decision before investing!

Is it possible to lose all your money?

If the project you invested in is a scam, fails due to poor execution and performance, or the token simply decreases in popularity and value, you can lose some money.

Such losses can be avoided by researching each project and choosing a reliable launchpad that has its own due diligence procedure and vetting process and security standards, like BullPerks.

How IDO Works on BullPerks

BullPerks cares deeply about its community security, both financially and data-wise. While the risk can't be liquidated entirely on any platform, BullPerks reduces the failure rate by performing a rigorous vetting process and conducting its own due diligence.

The company checks the viability of the projects and its founders' track record and dives deep into technicalities. We dug into every detail about the initiative, so our platform is filled with legitimate promising projects.

Don't miss out on the opportunity to invest in the most promising crypto projects of 2023! Our expertly curated list of the best crypto launchpads will be unveiled soon on another page. Whether you're a seasoned investor or new to the game, this is your chance to discover the next big thing in crypto.

Bottomline

In the crypto space, opportunities are coming at us fast, and we must act quickly not to lose a potential deal. However, like any other type of investment, it has its risks, and every investor must study their prospective projects before investing.

While IDOs are still high-risk investments, their profitable returns and secure transactions guaranteed by the blockchain can make the risk worth it.

We hope you've enjoyed our IDO crypto guide, and learned more about the initial DEX offering and initial exchange offering, and how to raise funds. Keep in mind that while reading our BullPerks blog, you can always find out about smart contracts, token sales, initial DEX offerings, liquidity pools, investment capital, cryptocurrency projects, liquidity pool providers, and more.

Would you like to start investing in the most promising crypto projects? Learn how to invest with BullPerks, the fairest and most community-oriented decentralized VC and multichain launchpad!

Disclaimer. This material should not be construed as a basis for making investment decisions or as a recommendation to participate in investment transactions. Trading digital assets may involve significant risks and can result in the loss of invested capital. Therefore, you must ensure that you fully understand the risk involved, consider your level of experience, investment objectives, and seek independent financial advice if necessary.